Whether oil prices are facing a change in direction or whether this will only be pause before continuing declines

Brent oil price technical analysis forecast

Crude oil prices climbed above 53 $ late last month, a bullish signal, also Brent traded above 62$ and reaching to major resistance

Just a few of months ago, analysts and investment banks slashed their oil price forecasts as OPEC’s production cuts drew down the global oil oversupply slower than initially expected, and rising U.S. shale production capped any short-lived oil price gains.

at the end of the summer, as OPEC and the International Energy Agency (IEA) started reporting stronger-than-expected global oil demand growth and an accelerated pace of inventory declines, the market sentiment began to change. As 2018 and the November 30 OPEC meeting draw nigh, the cartel is said to be favoring a 9-month extension of the deal through the end of next year.

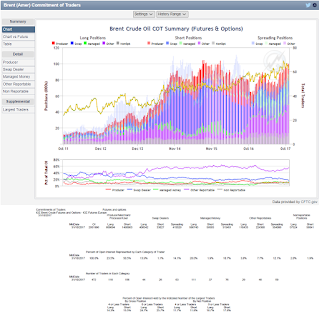

Opec increasingly signals an extension of output cuts and worldwide supplies tighten, hedge fund wagers on rising prices for the global benchmark broke a record set in September. Bets were placed as futures jumped above $60 a barrel, a level investors hadn’t seen in more than two years.

Hedge funds raised their Brent net-long position – the difference between bets on a price increase and wagers on a drop – by 4.6% to 530,237 contracts in the week ended October 31, according to data from ICE Futures Europe. Longs jumped by 3.6%, also rising to a record high, while shorts slipped 5.4% to the lowest since February.

technical analysis image shows us that there is some majors resistance at the 66-68$ price, if those levels will break up we should expect to see the 77$ price, if not so the major trend will continue down

|

| BRENT OIL FORECAST |

The possibility of such supply restriction throughout the whole of 2018—combined with expectations of strong oil demand growth and concerns over few new sources of supply due to years of underinvestment after the 2014 oil price crash—has created fear of a supply crunch next year.

EIA expects total U.S. crude oil production to average 9.2 million bpd this year and 9.9 million bpd next year, which would mark the highest annual average production in U.S. history, beating the previous record of 9.6 million bpd set in 1970

|

| brent oil position |

According to EIA : “In September and October 2017, the difference between domestic and foreign crude oil prices has risen to the highest level since 2015. In the past, price differences between West Texas Intermediate (WTI) and Brent crude oil led to changes in crude oil supply for petroleum refineries in the U.S. East Coast region. However, recent price changes are not expected to affect East Coast crude oil supply unless the gap continues and widens.

Between 2011 and 2013, when domestic crude oil prices (WTI) ranged from $3 per barrel (b) to $27/b lower than foreign crude oil (Brent) on a monthly average basis, refineries on the U.S. East Coast changed how they were supplied with crude oil. The recent price spread, which has averaged $6/b in September and October, has not grown large enough—and is not expected to last long enough—for changes similar to those seen between 2011 and 2013

Other factors have changed since the 2011–2013 period. Crude oil suppliers to East Coast refineries have found other outlets for their crude oil, such as refineries in other regions and export markets. Expanded pipeline infrastructure has given domestic crude oil producers access to refiners in the Midwest and Gulf Coast regions, reducing the need to ship crude oil by rail.

In December 2015, restrictions on exporting domestic crude oil were removed, so East Coast refiners must now compete with international buyers for domestic crude oil, and pay the typically higher coastwise-compliant shipping rates for a U.S. Gulf Coast-to-U.S. East Coast tanker shipment. U.S. East Coast refiners are unlikely to repeat shifts in crude oil supply patterns despite the widening price difference”

Opec increasingly signals an extension of output cuts and worldwide supplies tighten, hedge fund wagers on rising prices for the global benchmark broke a record set in September. Bets were placed as futures jumped above $60 a barrel, a level investors hadn’t seen in more than two years.

Hedge funds raised their Brent net-long position – the difference between bets on a price increase and wagers on a drop – by 4.6% to 530,237 contracts in the week ended October 31, according to data from ICE Futures Europe. Longs jumped by 3.6%, also rising to a record high, while shorts slipped 5.4% to the lowest since February.

Other utilities to get an impression of the expectations of the Brent prices:

|

| crude vs brent |

few words on the crude oil wti : as long as price traded above 52.60+_ the trend is up

|

| crude oil |

This review does not including any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice

No comments:

Post a Comment