Two years of shuffling prices in New Zealand dollars are about to end get ready

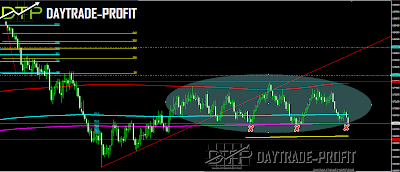

NZD/USD Technical Analysis

For two years now, the New Zealand dollar has been treading a region of 500 pips from the upper limit to the lower border, when it will end and where it will probably lead?

All the signs for my opinion indicate lower numbers ahead -continue weakening New Zealand against the dollar

We can see that apart from the recent strengthening of the dollar in the world and the fundamentals that support it, we can see on the graph that there are a number of things that show the future and it does not look pink

|

| NZD USD ANALYSIS |

Technical analysis:

we have a pattern – it could be that we see here Gartley pattern if this the situation so we should expect to see lower number below the last lows, while a break above 0.7340-0.7460 could take him to 0.79 area

The NZD/USD might need to see further strength to move above the 0.7340-0.74400 resistance, which could indicate make new highs at 0.79 area; break below 0.6940+_ may expose what could be another step down below the previous lows key resistance area below the 0.6760 level

Break down 0.6670-0.6780 will lead NZDUSD to lower prices 0.61' and even lower to 0.53-0.59

|

| KIWI ANALYSIS |

This review does not including any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice

No comments:

Post a Comment