Is usd jpy price solid ground for trend increases ,or just a stop?

USD/JPY Price Technical Analysis Forecast

USD/JPY strengthens last week due to a good NFP report, In addition, knowing the possibility of holding talks and meeting the President of the United States with the North Korean ruler, that news are reducing tension and negative pressure on the jpy

But the trend is still bearish, USD jpy stay below 109.60+_ resistance. Considering bullish convergence condition only decisive if there will be break adobe 109.60 it will indicate term reversal. In such case, outlook will be turned bullish. But on the other hand, Break down last lows of 105.30 will confirm more lows to the 100.70+_ target price, minor resistance stay in 107.30 price area.

|

| USD JPY TECHNICAL ANALYSIS |

If we go back and look at the trend and behavior of the USD / JPY pair we can see some interesting things

You do not have to go too far, you can look at the pair's analysis in 2016 - before Trump's election I wrote a review of the pair, the goals were achieved, but that is not the essential issue

What is essential is the future expectation of the move, by looking back at the years 98-99 that still show me the same pattern

"Once again I turn your's attention to 1998-1999

Note the charts: If the photo is indeed the same, then it is fitting for

Continued increases in the usdjpy, move into a similar facility."

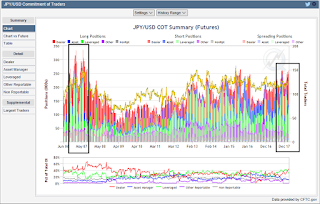

The cot report clearly shows how the trend is reversed in the face of the positions.

Pay attention to 3 past cases that show the same behavior.

I will deliberately focus on two of them because the third in 2016 you will see up in the post.

Years 2007-2008: USD JPY decline from the level of level 111 to 78 in 2011

I marked the process of changing the positions in a red circle.

The years 2013-2015 can be clearly seen in the position change given a break above what took the usd jpy pair to an impressive move up until the middle of the end of 2015

Why do I show you all this - because once again if you pay good attention you can see the buds that this move and change positions take place before our eyes, will this time also work and usd jpy will give the target: I think yes

if you will notice well, you can see the same behavior on position map on mid-late 2007, if that is the case so probably we If the image analysis is the same then one should expect further declines on usd jpy pair

|

| usd jpy position |

This review does not including any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice

No comments:

Post a Comment