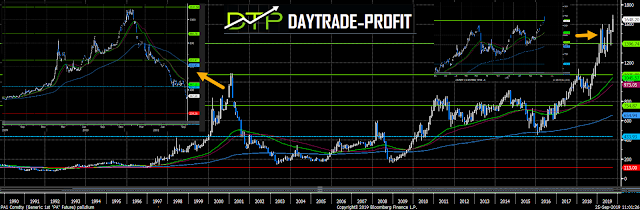

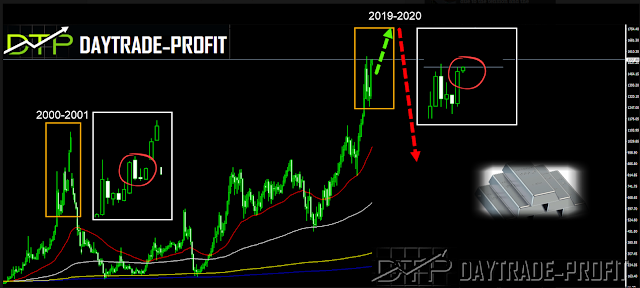

its look that we get replay of 2001 in palladium

Palladium Analysis

Palladium is a component of industrial output and economic output for many industries; Vehicles, technology, medical devices and equipment and many others.Some argue that if the price of palladium goes down, it could cause a weakening or weakening of the global economic outlook, and it may be an early warning that global stock markets are about to enter a period of extended price weakness.

Palladium exploded to a record high over the past month, rising around 15%, the largest monthly profit in metals - $ 1,647

The transition to renewable and green energy, especially in the field of transport, has led to an increase in demand for certain metals that have not been used in the past - the palladium metal is positively correlated with the automotive industry as 80% of its demand comes from automobiles

|

| Palladium future |

I've written late July - Is this a replay of 2001?

Palladium Three comes out one: Is this just the beginning of the journey, Double Top or a replay of 2000-2001

|

| palladium forecast |

Palladium Technical analysis

Third option chosen

Now we need to expect for more up movements to those areas:

1726

1827

1920

looking COT data - we can see increase in long position :

|

| palladium analysis |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment