What is the next step of the Canadian dollar

Canadian Dollar Technical analysis forecast

USD/CAD long time no speak ….

From the last post Stagnating Price of the Canadian Dollar Facing on End

Not so much change but we should expect for more corrections in his pair, as far as I’m seeing at the charts there is more room for downside target's, let's say that 1.2830+_ area will show on the chart as long as USD/CAD didn't manage to go up above 1.3240+_ on daily basis

|

| USD/CAD |

On Tuesday, February 07 2017 there is some news Balance of Trade and Canada Business Confidence, this could move and affect the Lonny movement – especially we need to focus on the Canada Balance of Trade result:

* “Canada's merchandise trade balance posted a surplus of CAD 0.53 billion in November of 2016, following a downwardly revised CAD 1.02 billion shortfalls in the previous month and beating market expectations of a CAD 1.6 billion deficit. It was the first trade surplus since September 2014, as exports rose 4.3 percent while imports increased 0.7 percent. The balance of Trade in Canada averaged 1452.84 CAD Million from 1971 until 2016, reaching an all-time high of 8524.80 CAD Million in January of 2001 and a record low of -4246.40 CAD Million in September of 2016..”

*trading economics

|

| USD/CAD |

If U.S. demand rises, manufacturers will need to order more oil to keep up with demand. This can lead to a rise in oil prices, which might lead to a fall in USD/CAD, while from the other hand

If U.S. demand falls, manufacturers may decide to chill out since they don’t need to make more goods. Demand for oil might fall, which could hurt demand for the CAD.

correlation with USD/CAD of about 93% between 2000 through 2016.

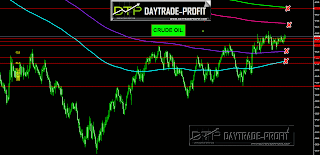

I expect to see oil prices go to 56-57 soon, this will give a push to the loony

|

| CRUDE OIL |

From a quick look on the COT table we can see:

swap dealer Short positions increased while Managed Money long positions increased, the interesting thing is the net position, marked with red: the cad position slowly decreased, last time it was low were in April 2016 , and before that when the uptrend started in ; late 2012

|

| Canadian dollar cot position |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment