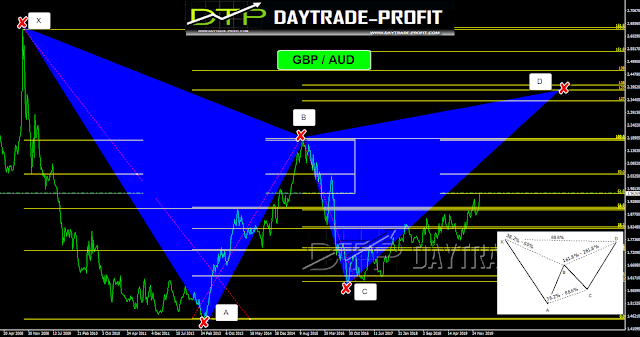

Big moves in the Fx markets and rewarding profit Under our noses ?

Harmonic Trading pattern

It is not every day that you can identify and see big moves in the market - especially when it comes to foreign exchange pairsSometimes it seems grandiose and obviously unlikely to come up with templates that give big and rewarding moves but this can comes, and come in big.

In my years I have caught on to some big moves that have taken place in the Forex market

The jpy pairings in 2013

And the Canadian dollar

Do we also have something big in front of us here, with a large Potential movement?

According to the technical analysis and harmonic patterns, it seems so!

Remember the post on How to achieve 3600 pips

Good technical eyes, patient and stick to the plan and you can earn from the big movement in the

markets and make profits

now I'm talking about the Australian pound: GBP /AUD

The first gives a target of 2.30-2.40 area which is equivalent to 20% yield

The second gives a target of 2.70-2.80 which is equivalent to 40% yield

|

| harmonic trading pattern |

An important thing in such transactions! Because it is a cross, so the changes are big, there are 2 independent currencies in their behavior - this is not a major (currency versus dollar or euro) so the moves are bigger and more radical

The stop for such a deal is far away - a magnitude of 9%!

This should be taken into account when entering into the trade

It's not a deal that is checked every day and every hour

And now let's go and see from the technical side what things are supposed to be

I'll actually start with the "more solid" pattern

Bearish Bat pattern.

AB leg can retrace between 38.2% – 50% of XA leg

BC leg can retrace between 38.2% – 88.6% of AB leg

CD leg can retrace up to 88.6% of XA leg

CD leg can also be an extension of between 1.618% – 2.618% of AB leg

|

| harmonic trading sample |

The second harmonic pattern

Bearish Gartley pattern

AB must retrace 61.8% of the XA leg

BC can retrace between 38.2% – 88.6% of AB

CD can be an extension of 1.272% – 1.618% of AB

CD can also be a retrenchment of up to 78.6% of XA leg

|

| trading pattern |

risk-reward now looks good to enter this trade with support on the lines- see sample

break this down will probably lead the pair to 1.82+_

|

| risk reward chart |

All I want to show you, that with the right way, stick to the plan, risk management, Looking beyond the curtain and Wisely technical analysis you can catch huge movement and make profits!

i wish you all the best trades

This review does not include any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice

No comments:

Post a Comment