is it the time to be or not to be in the markets

An interesting year awaits us in the markets

Everyone was waiting for the January effect

In the meantime, they appear to have received a January defect

What next ???

An interesting year awaits us in the markets - I wrote about this in the last article and it is worth reading

Will we see this year's numbers above 5000 or below 4000 or maybe even both...

The corona is here to stay one way or another and everyone seems to understand that

The question is whether the risks are already priced, or is their excessive confidence here, and the continuation of the markets is not priced at all

In my opinion, technically the market is still long

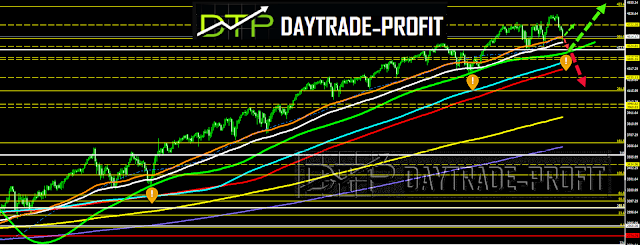

If you look purely technically at the leading S&P 500 index, then you can see notable things:

chart Trend - Corona Strips moves

The support of the Green Strip during the slump of the S&P 500 in February 2020:

Twice touched it, October 2020, and October 2021.

To summarize things - Long is a trend as long as the S&P 500 is trading above 4450 points levels

|

| S&P 500 forecast |

Short term: Breaking area 4583 will lead to the area I mentioned, opposite Long above this level with a stop on the area of 4450 and reinforcement in the boat above area level 4620

Below the story changes!

|

| S&P 500 outlook |

Also suggests looking and reading this too

p.s

In terms of the forex segment, there are currently no signs of anything serious and usually, the forex market is ahead of the stock market

Good luck - a productive and healthy trading year for everyone

No comments:

Post a Comment