An unusual year started how will it end?

Stock Markets forecast

Are there any signs of the coming future for stock markets in 2022?

I've already written about the S&P 500

This time ill focus on the Nasdaq

- Since a lot of

money in the IPO and private raising market is directed in favor of technology

stocks, Employee issues, chip shortages, salary levels, and bonus packages, It is

worth examining what is being done

There are many similarities in trading patterns to past moves, who’ve

started this way and ended differently

|

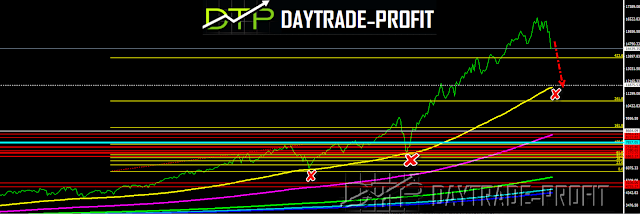

Nasdaq log chart |

Let’s try to see where we stand now?

Positively for markets

Raising interest rates, which is the standard tool for

fighting central bank inflation, risks weakening a fragile economy that is

still riddled with uncertainty - so it may not be certain that the measures

will be so bold and fast - there is a lack of clarity

Add to that companies on the U.S. stock market that have shed fat, and are beginning to converge on a model of decent value, and some might even say investment opportunities

On the other hand to the negative side

There are a considerable number of risks, from an epidemic

that is still ongoing

Potential military conflict between Russia and Ukraine

Supply problems in the global supply chain, and rising

inflation.

Transport and distribution costs are high

The cost of shipping a standard container from China to the U.S. West Coast remains more than three times what it was a year ago

Energy costs - The price increases of the energy sector are

important because they affect almost all sectors as a critical input

|

| Fed's interest rate |

Looking forward, the path of current and future Covid-19

variants is still unknown, which could weigh on supply chains

Supply chain snags continued to drive up the price

Strong consumer demand continues to drive up the cost of

shipping and energy.

Fed's interest rate hike and reducing purchases

The Federal Reserve said he will raise interest

rates in March and re-approved plans to end its bond purchases

now let's move to charts

on the negative side -as long the Nasdaq trade below 15,400 points (15,130-15,440) - the scenario could lead to more downtrends

|

| Nasdaq short scenario |

|

| Nasdaq long term short scenario |

|

| Nasdaq analysis |

No comments:

Post a Comment