Until when BOJ intervention on USD/JPY continues?

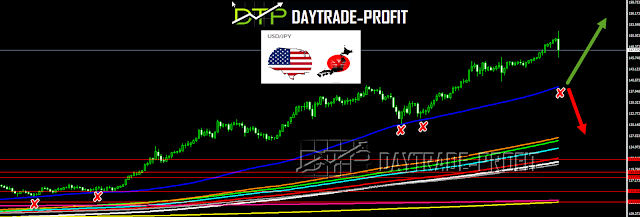

USD/JPY Technical analysis

last intervention from Japan was on Friday 21.10.22 after USD/JPY tested 152.00 to the upside before ultimately moving to lows of 146.23 in a quick, aggressive manner - price action that is indicative of official intervention.

There are some reasons for JPY weakness besides US dollar's strength

1. The Japanese household sector Tended to be more interested in foreign exchange margin trading and trading in cryptocurrencies, which are closer to speculation than to investment interest in jpy assets has been steadily increasing

2. U.S. share prices seen since 2020 reflects Japanese households’ desire to bet on foreign economies rather than on Japanese households’ investment appetite for foreign shares has taken

3. financial education triggering the shift away from savings toward investment.

interest in foreign investments, centering on U.S. shares, may be the prelude to a shift away from domestic assets.

4. investment activities will accelerate any time soon. However, Japan is a society where, once a certain trend catches on, everybody follows along with alacrity.

Now let's go examine charts and see what is expected

I'm looking for topping at 153- 155

No comments:

Post a Comment