2017 Recession Or Records In The Markets ?

Stronger US Dollar, Trump and Fed policy lead to recession or new records in 2017 ?

Twitter feeds Trump has become a powerful trading toolTrump decided to believe in the market and quickly concluded that if Trump would carry him so trade-in is to buy stocks and sell bonds - that he is planning infrastructure projects that will propel the stock and lead to inflation.

Indeed, we saw a really impressive surge in stocks - the big question is already embodied (forecast what will be ....?)

To affect the economy should pass resolutions, to sign decrees, to organize the majority in Congress for passing laws. Then you realize that even if you're president of the United States, not what you want you can move, not you pushing it happens, there is a complete set of constraints and brakes greatly reduce the space for your action. This limitation is difficult and frustrating much character limit Twitter

|

| MARKETS 2017 FORECAST |

There are a few risk factors, we should give them attention:

Presidential elections in France .... indicates extreme right bloc and calls for a referendum on leaving the European Union it will happen at Sunday, April 23

Italy: Party of Five Star comedian Grillo mouth quickly comes to power in elections and calls for a referendum on re-launching the Italian liras

UK: negotiations with the EU on BREXIT go wrong …target End-Mar 2017, with EU wanting to conclude by End-Oct 2018 plus UK: Local Government Election in May 2017

Germany: Federal election, Sep 2017

China trade war - Trump has been piped thing or two about China currency manipulator, the situation is that he will want and impose tariffs on imports from China Christ

US Trump’s first budget policy action will likely be to approve another short-term spending bill until the end of current FY2017 in Sep 2017, and the real and full-blown Trump’s budget will be for FY2018

Trump raises doubts about the commitments of the United States throughout the world, ISIS exploits of US disengagement from the world, and strengthened

|

| MARKETS 2017 OUTLOOK |

interest rate hikes in 2017: The Fed is now penciling in +75bps hikes in 2017, up from +50bps indicated at the 20-21 Sep 2016 FOMC meeting, but maintained the projected +75bps hikes for 2018 and cut the forecast for 2019 to +75bps from +100bps previously

|

| US DOLLAR |

On currencies, US Dollar is expected to strengthen at the expense of other major and regional currencies

|

| currency 2017 outlook |

with interest rate hikes, there is a need for U.S. economic recovery to begin exerting spillover effects that accelerate

exports from emerging countries to the U.S. so that clear-cut economic recoveries are seen in emerging countries

as well. However, in light of the sustained selling of emerging country currencies seen since the emergence of the

upcoming Trump presidency, it appears that there are not so many forex market participants who believe in that

scenario. whom should not have excessive faith in the sustainability of the current trend of surging U.S.

interest rates accompanied by rapid appreciation of USD against other currencies, and there ıs a possibility that ıt will be best off being prepared for a countertrend.

|

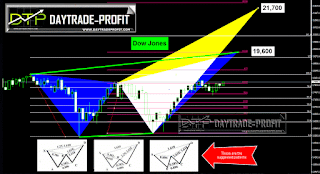

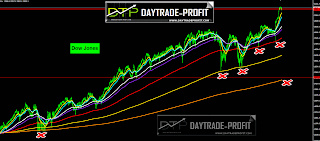

| Dow Jones analysis |

Now let’s move to the real stuff, the charts from technical analysis view:

I will focus on Dow JonesAs updates and during 2016 - watched new heights and indeed are hereNow I think the trend of rising risk - the latest move was based on expectations, not on factsI predict market correction was about to happen, whether during January's inauguration Trump began at 20 a month, or alternatively in MarchThe amendment process could occur I think in two directions:The first option for the correction of 13-17%A second option is more severe correction, even low levels of 20-30%Let's talk then be market testedFrom the technical side we can see few interesting things, step up could be at 20,300 pints +_ or even further to 21,700 pints +_

|

| markets technical analysis |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment