Can you put a mark and say that the trend in the Canadian dollar has changed ?

What is the trend and where is the USD CAD heading ?

Earnings season begins this week with three of the biggest US banks due to release their second quarter numbers. Citigroup (C), JPMorgan Chase & Co (JPM) and Wells Fargo & Co (WFC) will set the pace with results due on Friday.US banks enjoyed a boost after the Federal Reserve gave the all-clear to return all earnings to shareholders this year.

US inflation & retail sales

The big macro data comes from the US with key CPI inflation and retail sales numbers that could shift the dial on interest rate expectations.

Softer consumer spending and lower inflation is likely to pressure the Fed to row back on its commitment to raise interest rates at least once more this year. Complicating the picture, the yield on 2-year and longer-dated government bonds has contracted, raising concerns about a potential Fed policy ‘mistake’ that could herald a recession. The Fed has been forced to admit that inflation is declining and will not hit its 2% target this year. The worry is that if the Fed hikes too quickly the yield curve will invert with short-term rates above longer-term rates – a scenario that economists fear as it can cripple bank lending.

However, some better data in the last week or so, coupled with a notably hawkish shift from central banks globally, has seen the yield on the 10-year note rise again, which gives the Fed some breathing space.

More lackluster inflation will fuel bets the Fed will hold off further rate hikes, while anything above 2% should see the Fed hold course for now.

|

| usd cad forecast |

The Bank of Canada could be ready to raise interest rates for the first time in seven years when it meets on Wednesday.

Policymakers have been shifting expectations in recent weeks, preparing for what looks like a hike. Deputy Governor Carolyn Wilkins said in mid-June that Canada's economy was picking up and had moved beyond the “oil shock”. Governor Stephen Poloz has dropped hawkish hints of his own and the market is now pricing in a near evens chance that the central bank will raise rates. With the decision in the balance, the loonie could be in for a choppy session on July 12th.

This week key event is the BoC Rate Statement: Wednesday, 14:00. The BoC is expected to raise rates a quarter-point to 0.75%. This would be the first rate hike since July 2015 and could boost the Canadian dollar

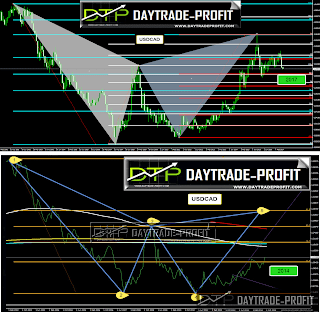

From Technical side on usd cad let's look on the charts:

USD/CAD fall below 1.30 last week and reached as low as 1.2858. now the trend become negative Initial bias remains on the downside this week.

On the upside, break of 1.3040 resistance is needed to signal short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

price actions from last top are seen as a correction pattern, Break of 1.2560 +_ will extend this correction to 1.1900 price area level

|

| usd cad technical analysis |

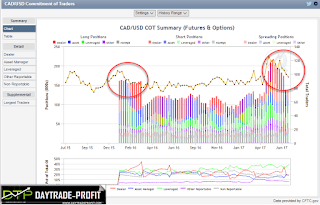

Cot position:

Don’t forget the connection between the cot position prices to cad, now we need to be focusing on the following charts – on the CME we can see the same behavior as feb 2016 net short position increase while long are decrease, on the retail side .

|

| usd cad position |

Final words:

Let's test the Canadian dollar compatibility we will see oil

prices the past weeks when the currency follows strong moves by the

expectation, at the moment I expect for radical moves

don't surprise if the amendment to the level of 1.2460

will bring big corrections but if oil will move more than that we

need to expect even stronger repair more at the level of 1.19

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment