Will GLOBAL MARKETS FOLLOW USDJPY TREND

Will GLOBAL MARKETS Follow USDJPY TREND

Well if the trend has been changed so I would expect to see some corrections before the next round, That’s mean if long term going to flop to the downside again,it want to be right away, we need to see and watch usdjpy makes some price corrections : the strong impulsive look of the rally from the usdjpy 80s price area in late 2012 till 126 price area in 2015 is not changed by day ,the first sign was broke down 114 areaAs I mention my last post on the usdjpy

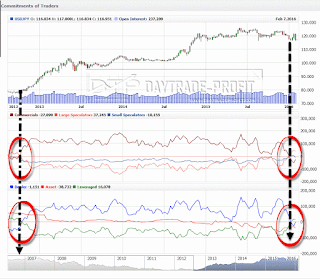

We saw the trend change by traders positions

From close look on the COT data usdjpy we see occurrence Surprising, Since the beginning of upward movement In 2012 the margin was more or less the same level, And now we are witnessing a fork returns, whether this heralds a return the jpy to Safe haven…….

All the way from late 2012 the cot show the net position for usdjpy was most of the time short position net by speculator traders until February when the trend has changed- what’s that mean …..

|

| usdjpy cot |

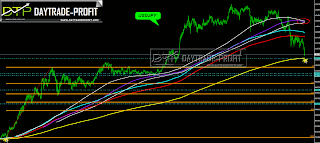

Technical outlook on the usdjpy:

Analysis of all assemblies, we can see Breaking area down from 114.30 to 80 pair, will lead to a strong descending process, USD/JPY dropped sharply to as low as 107.67 last week, the next support is located only at 106 area. Move in the future, may give a strong boost to Markets Exchanges a strong move downward

The dollar was chased to an 18-month low of 107.66 against the yen as risk-off trades in global equities combined with diminished expectations for the Federal Reserve to raise interest rates this month resulted in a five-day losing streak for USD/JPY. Traders kept a nervous eye out for Bank of Japan intervention when USD/JPY dipped its toe below 110.00. Although the BOJ never officially stepped in to halt the yen’s appreciation, members of the Japanese government, including Finance Minister, negative interest rates seem to have reached limitations, from the other side we see Now Japan’s yield curve remains at extremely low levels and the BOJ may have to buy private sector assets, this could give the JPY strengthening impact a bit of relief.

Bullish look on the jpy:

Expectations for an early FRB rate hike have dropped off sharply. As the markets continue to search for signs that, a rate hike could occur in June, there is unlikely to be any active dollar buying. Japanese institutional investors, may pile into overseas bonds entering the new fiscal year, but most of these will probably be hedged due to concerns of yen appreciation. Amid a dearth of clues or factors pointing to dollar bullishness against the yen, the currency pair is likely to move with a heavy topside throughout April.

Bearish look on the jpy:

April marks the start of the new Japanese fiscal year. Attention will focus on investments in overseas securities by Japanese institutional investors and pension funds. With the BOJ introducing negative interest rates, these investments are expected to be brisker than in regular years. The FOMC is expected to hold off from raising rates in April, but the possibility of such a move in June will probably act to support the dollar/yen pair.

Furfure move below 106 will lead to 104 area while my expectation are that we will get some bounce move to 114-116 area to check again the trend and if the pair will not cross those levels up it will be a great opportunity to sell usdjpy

|

| usdjpy |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment