Dollar Index analysis in 3 Easy Steps You Can trade

Dollar Index analysis in 3 Easy Steps You Can trade

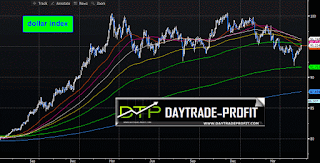

After The dollar index fell in 2.5.2016 below 92 this month for the first time since January 2015 ,he made rebound and jump almost 4 % since then ,dollar index price now 95.15dollar index which measures the dollar against a basket of currencies, rallied to its highest since late March on chances for an interest rate rise soon, and ended up 0.69 percent, EUR fell 0.85 percent to $1.1215,JPY fell 0.85 percent to 110.1, CAD fell 0.95 percent to 1.3030, |

| dollar index |

dollar index made the same way as I expected

Fed policy makers will gather again in Washington on June 14-15, and Chair Janet Yellen will discuss the decision in a press conference , so I do not expect to see some big changes before that ,also as I mention my last post on the dollar index we need to wait and see what will happen at 95-96 area ,Futures markets see the probability of an interest rate rise in June at 34 percent, up from 15 percent on Tuesday according to CME Fed Watch, recent comments from several Fed policymakers, and the minutes of the last policy meeting published on Wednesday have now all led analysts to see monetary policy tightening soon.

|

| dxy |

from the technical side on dollar index price: look on the charts we can see support at 94+_, dollar index rate should keep above those level to confirm more upside, fall through could take it to the next support level of 92-93 ,dollar index rate also is expected to find its first resistance at 95.30-60, and a rise through could take it to the next resistance level of 96.20, For my opinion we probably see the dollar index rate at least to 95.60-96 area for a test, if not low level such as 94.30 taken into consider

|

| us dollar |

Final words:

we can see there is more room for going up follows strong moves by the expectation,

don't surprise if we will see dollar index price going lower over the last lows,still to come test 95-96 area -break up again those levels, and holding above should give the dollar index prices to see higher level and even new records

we can see there is more room for going up follows strong moves by the expectation,

don't surprise if we will see dollar index price going lower over the last lows,still to come test 95-96 area -break up again those levels, and holding above should give the dollar index prices to see higher level and even new records

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment