How To Day Trade : Get 5 Trading Secrets

The Best Resources For Day Trade - Part Two

5 day trading secrets

Trader begins in world trade overall concept is wait patiently critical price levels (support or resistance), focus in number of instruments in parallel, without having to be moved to market movement, and when an order is seen, you need to run her on coldly basic technical methodThe emphasis is on position management includes planning prior written using simple decision-making process with only a small number of technical tools

A number of terms that accompany the reviews and are accompanied by a brief explanation of the form to work with them if you are day trading or just a trader

Long - Investment Instruments believes that the way up. In this case the trader buys the property and hope to sell it at a higher price.

In any case the day trader places a stop loss order also shaped the sale of the property at a lower price.

Long acting trader called "bullish".

Short - believes that investing in property in the downward direction. In this case the trader selling the property and hope to buy it at a lower price

In any case the day trader places a stop loss order is also the form of the purchase of the property at a higher price.

Short acting trader named "Bear"

For the avoidance of doubt, the short operation the same operation as long, just that she was in the opposite direction, that is, trying to make a profit

Now we will focus on a number of tools for day trading :

Horizontal support - a price level which previously served as the low point clear

Horizontal resistance - a price level which previously served as a level clear record

|

| Horizontal support |

Trend line - a rising trend line, connecting the two lows or more, and is used as a dynamic support. While the descending trend line, connecting at least two peak levels, and it should be used in future as a dynamic resistance

|

| Trend line |

Full bullish observation - This is a classic looking distinctly suited rising trend. When day trading looking Instruments is under such a long-term trader to seek support for entry and / or as soon as the outbreak of resistance

The entrance can make or break through the command "Stop Market" or using an aggressive "stop-limit" which allows entry with a little more confidence burglary

|

| bullish observation |

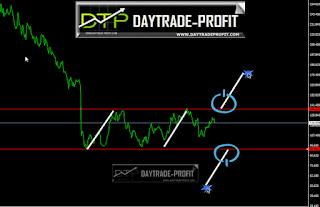

Neutral observation shuffle - day tarding looking one assumes Instruments should not break out of its previous price. Such observation appears rabbi after a period of a clear trend. Trading neutral should provide opportunities for both entrance Long and short entry

|

| Neutral observation shuffle |

Bearish observation - This is the classic observation corresponding instrument in a downtrend. day trader (per term it) that identifies a contract in downtrend should look for a shorting input only. The sale should be sought both possible resistance levels and breaking the support levels.

In case of breaking weekly support, the merchant waits patiently repeated opposition to issuers for review possible

The day trade also believes that the property dealer downtrend is weak, it is better for day trade to look for only Login sale possible resistance levels

|

| Bearish observation |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment