MARKETS FORECAST TECHNICAL ANALYSIS

MARKETS FORECAST TECHNICAL ANALYSIS

As I wrote my last post on SP500 index + Nasdaq 100 Index + Dow Jones going to

Increase the chances of a rate hike in the US and the lack of new incentives to the economy of Europe, stretching between the EU and the UK due to Brexit, dropped last week Wall Street stock exchanges significantly.On Friday, New York stock exchanges recorded the sharpest daily fall since the British decision to withdraw from the European Union.

index of Wall Street's volatility (VIX) jumped by 39% - the sharpest jump since the British decision to withdraw from the European Union in June - a record of more than two months after the president of the Federal Reserve Bank of Boston, Eric Rozngrn, said that he supports a gradual increase of interest rates in the US " b. federal Reserve Chairman Janet Yellen has already signaled her speech in Jackson Hole conference in late August that the stronger arguments in favor of another rate hike in the US economy approached US economy targets set by the central bank.

internal market what the Fed wants to make it clear to him that he is serious about a rate hike this time, whether it happens in September and December whether

I think there is still time, until it is said that an alternative to money in the bank deposit interest bearing than other assets including currencies, stocks and indices

To interest of 2.5% + _ should not be a big impact, according to historical data, interest, markets today are enormous credit balloon, and it might take the air, even earlier, then, to which the interest rate will reach 2.5%

|

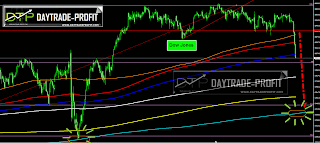

Dow Jones |

Now let’s examine the American locomotive - Dow Jones

As I wrote a review earlier this year, arguing that this would be a challenging and difficult year, at the beginning, we received strong declines in the markets and stock exchanges

Since October 2014, the markets were wide strip shuffle –This broke up last July by going to new high levels ,Now The situation now has become fragile Dow Jones Index back below the breakout gates and congestion

Dow Jones Technical analysis:

As long as index stay below 18,360-18,430 the short term is down, while from medium term outlook we need to keep an eye on 18,230 points, The situation now is this: the continued decline could reach the area 17600 + -, with an option to examine and test the level of 17380-17430, as if this level will break, the story starts to become much more complex

|

MARKETS FORECAST |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment