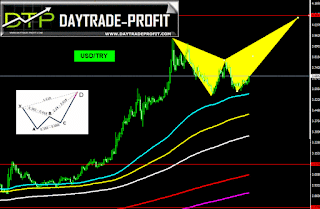

What an interesting pattern is created in the Turkish Lira

Turkish lira Price Technical Analysis Forecast update

Long time no speak about usdtry – it’s about time to take look on this pair, let’s test and review the Turkish lira momentum

From my last post, I wrote couple scenarios

The first option - breaking area of 3.82-3.86 will lead the usd try to cope with + 4.10

Option Two: Amendment to the 3.55 to 3.59 area and from there back to the peak, with the possibility of hacking the last high

A third option: correction down to 3.50 + _ and then re-examine the usd try pair again

So we get the third one

I noticed an interesting pattern in the chart, its called the crab pattern:

The structure was discovered by Scott Carney in 2001.

• AB leg can retrace anywhere between 38.2% up to 61.8%

• BC can retrace 38.2% – 88.6% of AB leg

• CD is an extension of up to 161.8% of XA leg

and is also an extension of 224% – 316% of the AB leg

and is also an extension of 224% – 316% of the AB leg

|

| Turkish lira forecast |

If this is the right angle and scenario we should expect to see the Turkish lira going to new high, above 4 to 4.11 +_ area, but first, we need to see daily close up above 3.71 area – this price is taken from the downtrend line from usdtry record

|

| USD/TRY |

Technical analysis long term

look closely, you can see the strong support at 3.49+_ , break down this level May cause usdtry breakdown mode and change the trend direction in the Turkish lira

|

| Turkish lira technical analysis |

This review does not including any document and/or file attached to it as an advice or recommendation to buy/sell securities and/or other advice

No comments:

Post a Comment