Do the British Pound and UK economy of the 1990s (the devaluation of the Pound in 1992) come back again?

Pound Dollar Technical analysis forecast update

All eyes will now be on the Bank of England’s today meeting at which policymakers are due to vote on interest rates. Members of the nine-person Monetary Policy Committee have warned that their tolerance for higher inflation, despite the weakness of the overall economy, is limited After the Brexit vote, growth was strong but then faded as rising import prices stoked inflation and hit households’ incomes more than that Sterling’s depreciation has hurt consumers, by fuelling inflation, more than it has helped exporters

The future for UK economy is not clear there is uncertainty over Britain’s future trading arrangements after Brexit

The latest Treasury round-up of independent forecasts by economists show this new thinking at work.In August 2016, economists expected net trade to contribute 0.5 percentage points to growth in 2017. But they now think trade’s contribution will be zero. And over the five years starting in 2017, the total contribution of trade to the UK economy is predicted to be not much more than nothing, at 0.2 percentage points.

|

| STERLING DOLLAR |

Technical analysis on the pound dollar

Expect strong resistance below 1.3300 to bring larger down trend resumption, while we have first to meet 1.3080. On the downside, break of 1.2840 support will indicate short-term topping. If it will fail to stay above the level it will be turned back to the downside for 1.2640 support current upside target for GBP/USD comes in ahead of this key resistance level, at approximately 1.3260- a break above this level ON DAILY CLOSE will test the trend for the GBP USD , This target was derived from the resistance (white band ) through all his decline from 1.57_+ area - mark on the chart below

As of today writing the post, the pound Sterling hovers near one-year high to1.3320 ahead of Bank of England meeting BUT CLOSED BELOW 1.3260

As of today writing the post, the pound Sterling hovers near one-year high to1.3320 ahead of Bank of England meeting BUT CLOSED BELOW 1.3260

|

| GBP USD ANALYSIS |

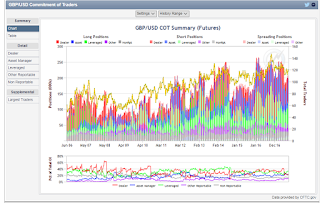

Focus on its the COT position trade report

See trend line it's still bearish, second is the shorts long position the same situation appears at 2015 so if that the case im expect to see the Sterling went down again

|

| POUND DOLLAR POSITION |

|

| GBP POSITION |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment