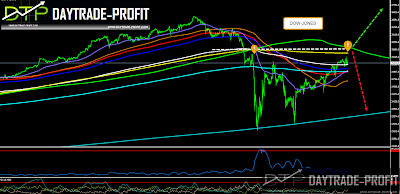

Two trading patterns in the price chart that can hint at the future in the markets

Has the danger passed and the realization is over?

The indices have indeed corrected well and now a majority reach critical test levels in my opinion

If the assumption of two trading patterns that can be formed will be implemented

Then interesting and beautiful movements can be expected

Two trading patterns in the price chart that can hint at the future in the markets

May lead the index again down to areas of 24300 points or even lower

Second pattern = Midnight success in the deserts of 25600 + _ in the extensive range of 25500-25800

May lead the index again down to areas of 24300 points

if you follow last posts, you all know and showed last predictions and wasn't surprised

|

| MARKETS FORECAST |

"" According to the sentiment and the graph, we are on the edge and therefore I think this is the point in which it is worth trying to check whether it will work

I am talking about trading, of course, on the indices when I assume that the markets are in the process of correcting whether I am healthy or not yet know

But patch down almost certainly - with a probability of more than 70%

Let’s build a test strategy

Short position with a stop of 3-4% and profit 7-8%

A ratio of 1: 2 in terms of chance of risk"

markets technical analysis patterns:

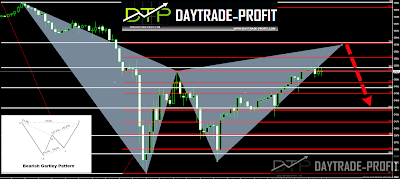

First one is the Bearish Gartley as follows:

AB must retrace 61.8% of the XA leg

BC can retrace between 38.2% – 88.6% of AB

CD can be an extension of 1.272% – 1.618% of AB

CD can also be a retracement of up to 78.6% of XA leg

The point D is known as the PRZ or Potential Reversal Zone

|

| Bearish Gartley |

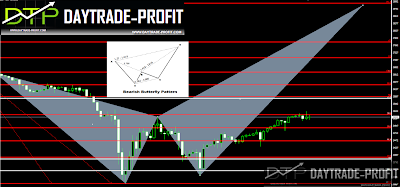

The second one is the Bearish Butterfly as follows:

AB can retrace up to 78.6% of the XA leg

BC can retrace between 38.2% – 88.6% of AB

CD can be an extension of 1.618% – 2.618% of AB

CD can also be an extension of up to 1.272% – 1.618% of XA leg

The point D is known as the PRZ or Potential Reversal Zone

|

| Bearish Butterfly |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment