are we wittiness start of the pullback on markets or its only a correction

stock markets analysis

Indices continue to break new records except for the Dow Jones, earning reporting season is almost finish -NASDAQ 100 and SP 500 has made a new all-time high

What is expected for the future , one index (DJ) is trailing behind, while the other 2 (Nasdaq +sp 500) are leading the sled of Santa Tramp, will 2 dogs chase the slow dog to increase pace, or is he slowing down the rest of the journey?

only the Dow seems to be behind them - for getting approve on the DOW i want to see him cross 26,830 points - if so then we can get for more uptrend to 27600+_

Yesterday we saw weakness and whether it will develop into something larger or it is only a correction: Right now everything is under control

stock market approaches all-time ,are we going to see new records Or it turns out to be a false one

I checked past moves - rapid recovery or break-up led to a 40% to 43%

If this time, too, this is the direction - it can manage with the Dow's goals that I gave, and then we will see the NASDAQ index rise above 8,000 points to 8200-8400

but for now lest focus on the present because the Dow didn't mange to cross 26830 points !

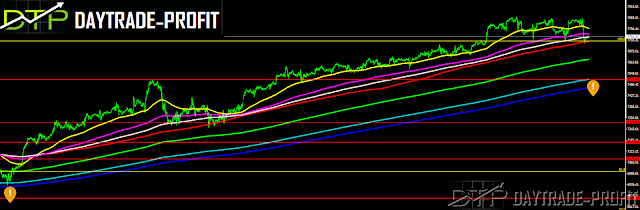

Let's start with the NASDAQ index :

From a technical point of view, a number of critical levels can be seen in the index:

break down 7480-7530 points will signal a return to a negative trend in my opinion

As long as these levels are traded, the correction is reasonable and healthy for a strong upward move from January

|

| NASDAQ ANALYSIS |

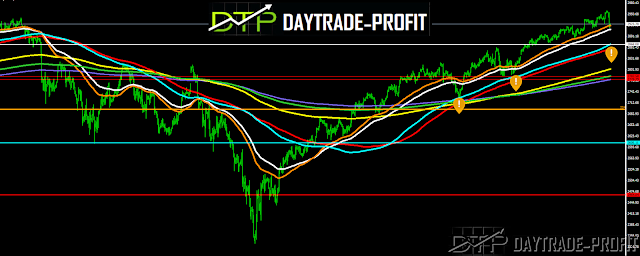

Now move on to SP 500 index

From a technical point of view, a number of critical levels can be seen in the index:

break down 2830-60 points will signal a return to a negative trend in my opinion

As long as these levels are traded, the correction is reasonable and healthy for a strong upward move from January

From a technical point of view, a number of critical levels can be seen in the index:

break down 2830-60 points will signal a return to a negative trend in my opinion

As long as these levels are traded, the correction is reasonable and healthy for a strong upward move from January

|

| SP 500 ANALYSIS |

There are a few things you should pay attention to:The indices

reach extreme levels before the journey continues upwards, or is this the end of the correction?

Facebook has released reports yesterday and costs over 11% - comes to check the Gap, the refractive levels of the rising move: if it closes above the $ 171 area, we have a set up here to catch a move to close the top - it's worth watching closely!

Amazon, as I have mentioned several times, should cross the 1760 area in order to show a continuing upward trend! If the conditions that I have mentioned exist, expect another incremental move

If not then the story is different:

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment