What happened to the stock exchange when inflation raised above 3%?

What happened to the stock exchange, when inflation raised above 3%?

As you probably know those tracks, I basically used to analyze the technical point markets,

But this time, I will also try to give emphasis, number of warning signs that appear in markets from the economic side, and not only technical

I wrote a post earlier this year and last year I raised the scenario of creating new records in Stock Exchanges and it happened

I went back and wrote, the current period is very reminiscent of the years 1998 to 1999

ill split this subject into two parts, this article will be on the economic side, while the next one will be more technical.

You know The Holy Trinity:

CREDIT + RATE + INFLATION = MARKETS

Up Up Up = DOWN

The impact of these three factors on the economy, not the short term, is choking, or alternatively a Lack of liquidity and recession

I’ll start with inflation:

Now let’s see the impact of inflation rate on the markets: from looking at the charts, we can see the effect of inflation on the market – 3 times before in 1999 2008 2011, when inflation reached to 3.5%_+ the markets started went down, now the inflation in us is standing on 2.7%, U.S. inflation soared 2.7% through the 12 months ended February.

|

| inflation vs markets |

The expectation for the coming months shows that we are very close to the level of 3%, it Will be very interesting to see how the markets react, return of the high-interest rate environment, combined with inflation levels of over 3%

|

| forecast inflation |

The second element is the rate:

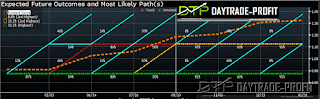

Everyone has heard and saw the era of zero interest rates came to an endNow after the fed raise the rate, and plans to increase rate two times more during this year, fact, the expected future outcome is standing on 1.3% +_

|

| expected future rate |

The third issue is credit:

don’t forget the loans and credits to the private sectors across the world, this is only going up, It is not something to be taken lightly, Combination of rising interest rates, casserole recipe is a creation of suffocation |

| credit loan |

I saw this chart; you should pay attention to an image:

The U.S. equity market excluding foreign issues as a ratio of nominal GNP is near the bubble peak 1998-1999. The S&P 500 market cap as a ratio to S&P 500 revenues is also near the high seen in the late 1990s.

See you in the next article, the second part of the theme, which will focus on other factors, and of course the technical aspect

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment