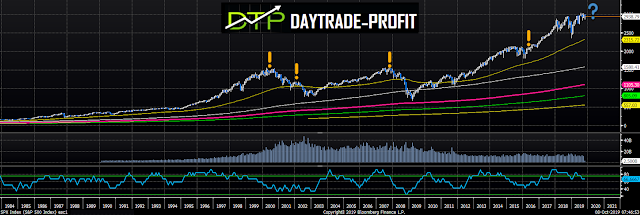

Is it time for disillusionment or the increases in markets mainly since 2018 based on "hopes" will continue

Markets Technical Analysis

Last week we saw the markets performed strong moves - price was driven by a combination of slowing economic data and geopolitical risks - expect high volatility until the uncertainty of a trade deal between the United States and China will endThis month we expect for meeting between us and china and also see what will happen with UK ( BREXIT date need to be till the end of October) and off course formal start of Q3 earnings In US -this week is last week before earnings season

The futures market indicates 76% chances of a rate cut later this month - in 30th October FOMC Statement US Federal Funds Rate & Press Conference

Markets Closing this week is

very critical for continuing - have we seen a near-term bottom- or its only halt?

Will this time (be the third in

number) remember as the Bears winning number?

September 2018 to December 2018,

sharp declines and from there rise

For new highs.

May this year 2019 to June, again

declines and once again rise to new highs

August this year 2019 to September

again declines and once again rise to new highs

And this time..... Will this time

come back the scenario that was the previous two times, or is this time

different?

P.S look my last post on the

markets: Is

the road paved and safe for the continuation markets journey?

spoken and mentioned many times in

the past about the extra assets that warn about something else and they proved

themselves in the past

Some of them continue to run

exactly according to the plan and the templates, and if this is the plan and

the pattern then..... We should expect something else this time

|

| SP 500 |

Slowing world trade

Global economic growth is experiencing a slowdown. This economic weakness is more pronounced outside the United States than in the United States, but even there has already begun to seep - the world is round

The Bears are quick to jump on this weakness as a reason why the U.S. stock market will fall. How many times have you heard those words in the last 10 years?

1. Emerging market / China weakness will lead to US stock market crash!

2. European problems will lead to infection in the US!

3. The bubble of developed countries will lead to economic recession and the US bear market

In dominoes when one stone falls then the other too

Something on a personal note

In my opinion we are ahead of an explosion - a crisis in Turkey seems inevitable

Trade agreement not yet signed - Expected expectations and actions nothing if the markets compete agreement and it will not happen ..... or vice versa bought rumored to know

Barcasit - Laughter Laughter But it's just a bad joke - Not successful, and not knowing what they want of themselves, these British, and it drives Europe crazy - The question how to get out of this mess

U.S. housing weakness and bond yields

The question is, not whether we are downhill but when - I am not ruling out new highs but .... It will not be a real rally but a fool's rally in my opinion

Under the surface and it's no secret - everyone knows unintelligible things are happening

There are many tensions and asymmetries in the behavior of the markets

I'm pretty sure it won't end in the best hope of being lost

My models and properties also show contradictions and this is very confusing

There are the gold and Bitcoin oil stocks and of course the Forex - all of these can be seen as not easy to digest and this will end up in the stock market as well - never resilient

In 2008, when the Fed launched into emergency strategy to bail out the financial markets with WE, the Fed's balance sheet was about $ 915 Billion, rate was at 4.2%.

Now if the market falls into a recession tomorrow, the Fed would start with roughly a $ 4 Trillion balance sheet with interest rates 2% lower than they were in 2009.

The Fed's ability to "bail out" the markets today is much more limited than it was in 2008.

The upswing in the markets mainly since 2018 based on "hopes" - they have held the story of highs in the market despite weakening earnings growth and estimates

stocks markets Tracking since the last slump, see below

A reassessment or a healthy correction to the violence experienced

by stock indices

Look on the future E mini 500 (Sp 500)

If it is only a halt then we should see the Sp 500 crossing up again 2967-2973 points ,otherwise the case could became uglier......

|

| E mini 500 |

one more thing from the cot report :

if we will look closely we can see that this time meanwhile its look the same behavior as appears on last corrections in 2019

|

| Sp 500 position |

This review does not including any document and / or file attached to it as an advice or recommendation to buy / sell securities and / or other advice

No comments:

Post a Comment